How Pet Dog Insurance Policy Can Aid You Conserve on Vet Expenses

Family pet insurance offers as a strategic financial device for pet owners, attending to the uncertain nature of vet expenses. What variables should pet proprietors prioritize when assessing their alternatives?

Comprehending Family Pet Insurance Fundamentals

Exactly how can family pet insurance alleviate the financial concern of unanticipated veterinary costs? Pet insurance policy works as an economic safeguard for pet owners, offering satisfaction when confronted with unforeseen clinical prices. By covering a substantial portion of veterinary costs, pet insurance policy can help reduce the stress and anxiety that develops from emergency situations, persistent health problems, or mishaps that call for prompt focus.

Understanding the fundamentals of pet insurance coverage includes identifying its core parts, consisting of costs, deductibles, and repayment prices. Premiums are the annual or monthly payments required to maintain protection. Deductibles, on the various other hand, are the out-of-pocket costs that animal owners must pay prior to the insurance plan starts to give insurance coverage. Reimbursement rates figure out the portion of eligible expenses that the insurance company will cover after the deductible is fulfilled.

Being notified concerning these elements enables family pet owners to make sound decisions when selecting a policy that aligns with their financial circumstances and their family pets' health demands. Inevitably, understanding the principles of animal insurance coverage can equip pet owners to guard their fuzzy friends while efficiently handling veterinary expenses.

Kinds Of Pet Dog Insurance Policy Program

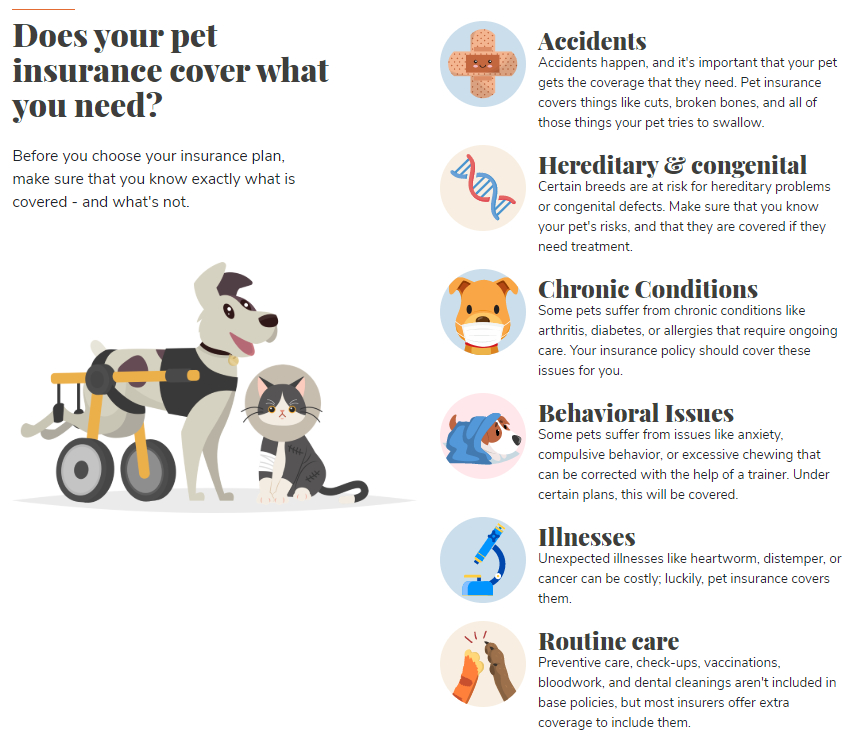

Pet insurance coverage prepares can be found in different types, each designed to meet the varied requirements of family pet proprietors and their pet dogs. The most common types include accident-only plans, which cover injuries resulting from mishaps yet leave out illnesses. These plans are commonly extra budget friendly, making them appealing for those looking for standard protection.

Thorough strategies, on the various other hand, give a wider scope of insurance coverage by encompassing both ailments and crashes. This type of plan generally consists of arrangements for numerous veterinary services, such as diagnostics, surgical procedures, and prescription medicines, therefore providing even more considerable monetary protection.

Another alternative is a wellness or precautionary care strategy, which concentrates on routine health and wellness upkeep (Insurance). These plans frequently cover inoculations, annual examinations, and oral cleansings, helping family pet proprietors in taking care of preventative care costs

Last but not least, there are customizable plans that allow family pet proprietors to tailor insurance coverage to their certain requirements, allowing them to pick deductibles, compensation rates, and added benefits. Understanding these various sorts of pet dog insurance policy prepares allows family pet owners to make enlightened decisions, ensuring they choose the most effective fit for their precious companions.

Cost Contrast of Vet Care

When assessing the monetary aspects of pet ownership, an expense contrast of vet care becomes necessary for responsible animal guardians. Veterinary costs can vary significantly based upon the kind of treatment called for, the location of the vet clinic, and the specific requirements of the animal. Routine services such as vaccinations and annual exams tend to be less costly, generally ranging from $100 to $300 yearly. Nonetheless, unpredicted medical concerns can rise expenses drastically, with first aid possibly reaching numerous thousand dollars.

As an example, treatment for typical problems like ear infections may cost between $200 and $400, while Check Out Your URL more severe problems, such as diabetes or cancer cells, might bring about expenses exceeding $5,000 over time. In addition, diagnostic treatments, consisting of X-rays and blood examinations, better add to the total cost burden.

Comparing vet costs throughout various facilities and understanding the kinds of solutions supplied can help animal owners make educated choices. This contrast not only help in budgeting for anticipated costs but likewise prepares guardians for potential emergency situations, underscoring the relevance of monetary planning in pet possession.

How Insurance Decreases Financial Anxiety

Browsing the intricacies of vet costs can be frustrating for pet proprietors, specifically when unexpected health issues emerge. The monetary problem of emergency situation treatments, surgical procedures, or persistent condition monitoring can rapidly rise, resulting in significant anxiety for families already facing the psychological toll of their family pet's disease. Animal insurance policy functions as an important financial safeguard, enabling pet proprietors to concentrate on directory their pet's health instead of the placing expenses of care.

Along with guarding versus huge, unforeseen costs, family pet insurance policy can encourage routine vet treatment. Animal owners are more probable to look for preventive treatments and regular check-ups, understanding that these prices are partly covered. This proactive method can lead to better health and wellness outcomes for animals, inevitably improving the bond between family pet and owner while alleviating monetary tension.

Making the Many of Your Policy

Optimizing the advantages of your animal insurance coverage requires a proactive and educated method. Begin by extensively understanding your policy's terms, including protection restrictions, exemptions, and the claims process. Acquaint on your own with the waiting durations for particular problems, as this knowledge can help you navigate potential claims effectively.

Following, preserve extensive documents of your family pet's medical background, including vaccinations, therapies, and any type of pre-existing conditions. This documents can promote smoother cases and ensure that you get the insurance coverage you're qualified to when unexpected veterinary expenditures occur.

Regularly assess your plan to ensure it straightens with your pet dog's advancing health needs. Insurance. As your pet dog ages or if they establish chronic conditions, think about changing your protection to provide ample security versus intensifying costs

Finally, communicate honestly with your veterinarian regarding your insurance coverage strategy. They can help you comprehend which treatments are covered and overview you over here in making notified decisions for your family pet's wellness, ultimately boosting the value of your insurance coverage plan.

Conclusion

In final thought, animal insurance coverage offers as a valuable economic tool for animal owners, successfully alleviating the prices connected with veterinary care. Inevitably, pet dog insurance policy represents a proactive strategy to liable animal ownership.

Pet dog insurance policy serves as a tactical financial device for pet dog proprietors, dealing with the uncertain nature of vet expenditures. Family pet insurance coverage serves as an economic security web for family pet owners, supplying peace of mind when faced with unforeseen medical costs.Pet insurance policy prepares come in various kinds, each designed to meet the diverse requirements of pet dog owners and their animals. Family pet insurance policy offers as a beneficial financial security web, permitting pet proprietors to focus on their family pet's health rather than the installing expenses of care.

In final thought, pet insurance policy offers as an important financial tool for pet dog proprietors, properly alleviating the prices linked with veterinary treatment.

Comments on “The Impact of Innovation on the Future of Insurance Services”